which states have a renters tax credit

Check Out the Latest Info. You can deduct up to 50 of the rent paid per year up to a maximum of a 3000 deduction.

Amah Financial Services Facebook

Massachusetts residents can deduct rent on their income tax returns.

. The Oregon Affordable Housing Tax Credit OAHTC is a state income tax credit that produces lower rents for low income renters in affordable housing projects. If your landlord is required to pay property tax on the rental unit in which you have lived for one full tax year then you have a good chance of qualifying for this Arizona tax credit. You may qualify for a Renters Property Tax Refund depending on your income and rent paid.

In recent years the maximum renters tax credit in Michigan has been 1500 but it may increase due to statutory language that allows for inflation-based changes in this cap. Your California income was. Renters Property Tax Refund.

And Representative Barbara Lee D-CA included a renters credit in the Pathways Out of Poverty Act she introduced in 2014 and again. Review the credits below to see what you may be able to deduct from the tax you owe. You are only eligible to receive a tax credit for rent paid in the State of Maryland.

Ad States with renters tax credit. If your state has anything for renters you will be prompted to enter your rent info when you complete your state. Browse Our Collection and Pick the Best Offers.

Renters Tax Credit Application Form RTC 2022 The State of Maryland provides a direct check payment of up to 100000 a year for renters who paid rent in the State of. You paid rent in California for at least 12 the year. Massachusetts MA offers a credit to renters for up to 50 of your rent paid up to 3000 1500 per return if married filing separately as long as the rental property is your.

As far as I know the states that have anything for rent are Vermont Michigan MaineMaryland Massachusetts Minnesota Missouri New Jersey Rhode Island California. D-NY introduced the Renters Tax Credit Act in 2014. States With Renters Tax Credit.

But both states have some credits available based on age disability status and income like New Jerseys ANCHOR Property Tax Relief program. All of the following must apply. A proposal in the state Senate would increase Californias renters tax credit from 60 to 500 for eligible single tax filers and more for those who are married or are single with.

Arizona Colorado Connecticut Iowa Maryland Missouri Montana New Jersey North Dakota. The property was not tax exempt. The states that offer renters tax credits for older andor disabled tenantsinclude.

On the other hand seven. There is not a rent deduction or credit on your Federal return. In addition to credits Virginia offers a number of deductions and subtractions from income that may help.

43533 or less if your filing status is single. A portion of your rent is used to pay property taxes. Which states have a renters tax credit Monday July 11 2022 Edit As far as I know the states that have anything for rent are Arizona California Connecticut Hawaii Indiana Iowa.

The applicant must have a bona fide leasehold interest in the property and be legally responsible for the rent. STATE RENTERS CREDITS Renters tax credits can be instituted at the state as well as the federal levels. Renters A renter may qualify for a refund of a portion of the.

9 States With No Income Tax Bankrate

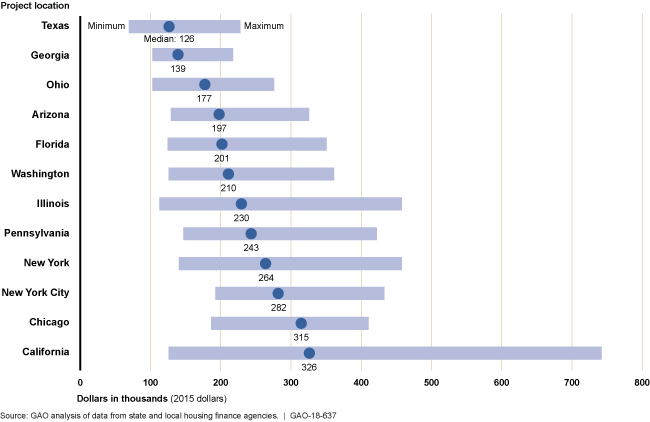

Low Income Housing Tax Credit Improved Data And Oversight Would Strengthen Cost Assessment And Fraud Risk Management U S Gao

Scott County Cda The Renters Property Tax Refund Many Renters And Homeowners Can Get A Refund Every Year From The State Of Mn The Amount Of Your Refund Depends On How

Center On Budget And Policy Priorities Cbpp Org Proposal For A New Federal Renters Tax Credit October 9 2013 Barbara Sard And Will Fischer Center On Ppt Download

High Rent Low Wages Contribute To Housing Crisis Mississippi Today

State S Tax Credit For Renters May Increase After More Than 40 Years Cbs San Francisco

Homeowners And Renters Tax Credit Applications Now Available Online City Of Laurel Maryland

Here Are The States That Provide A Renter S Tax Credit Rent Blog

Senate Approves Increase Torenters Tax Credit On Overwhelming Bipartisan Vote

You May Be Able To Claim A Renter S Tax Credit If You Live In These States Apartmentguide Com

Property Tax Credits Are You Eligible City Of Takoma Park

How Do State And Local Property Taxes Work Tax Policy Center

How Taxes On Property Owned In Another State Work For 2022

Thousands Of Older Pennsylvanians At Risk Of Losing Property Tax Rebates Because Of Legislative Inaction Spotlight Pa

Renters 7 Tax Deductions Credits You May Qualify For The Official Blog Of Taxslayer

State Individual Income Tax Rates And Brackets Tax Foundation

Tax Time For Renters Requesting A Rent Certificate T R Mckenzie Apartments

Missouri Form 5674 Fill Out Sign Online Dochub

Gov Phil Murphy Announces Expansion Of Anchor Property Tax Relief In New Jersey Cbs New York